ev tax credit bill retroactive

Simply put the Inflation Reduction Act includes a 7500 tax credit at the point of sale for new EVs and 4000 for used EVs. Base Credit of 4K.

2021 Ev Tax Credit Page 19 Tesla Motors Club

Theres massive confusion caused mostly by this thread so to clarify as the OP on that thread has not bothered correcting some.

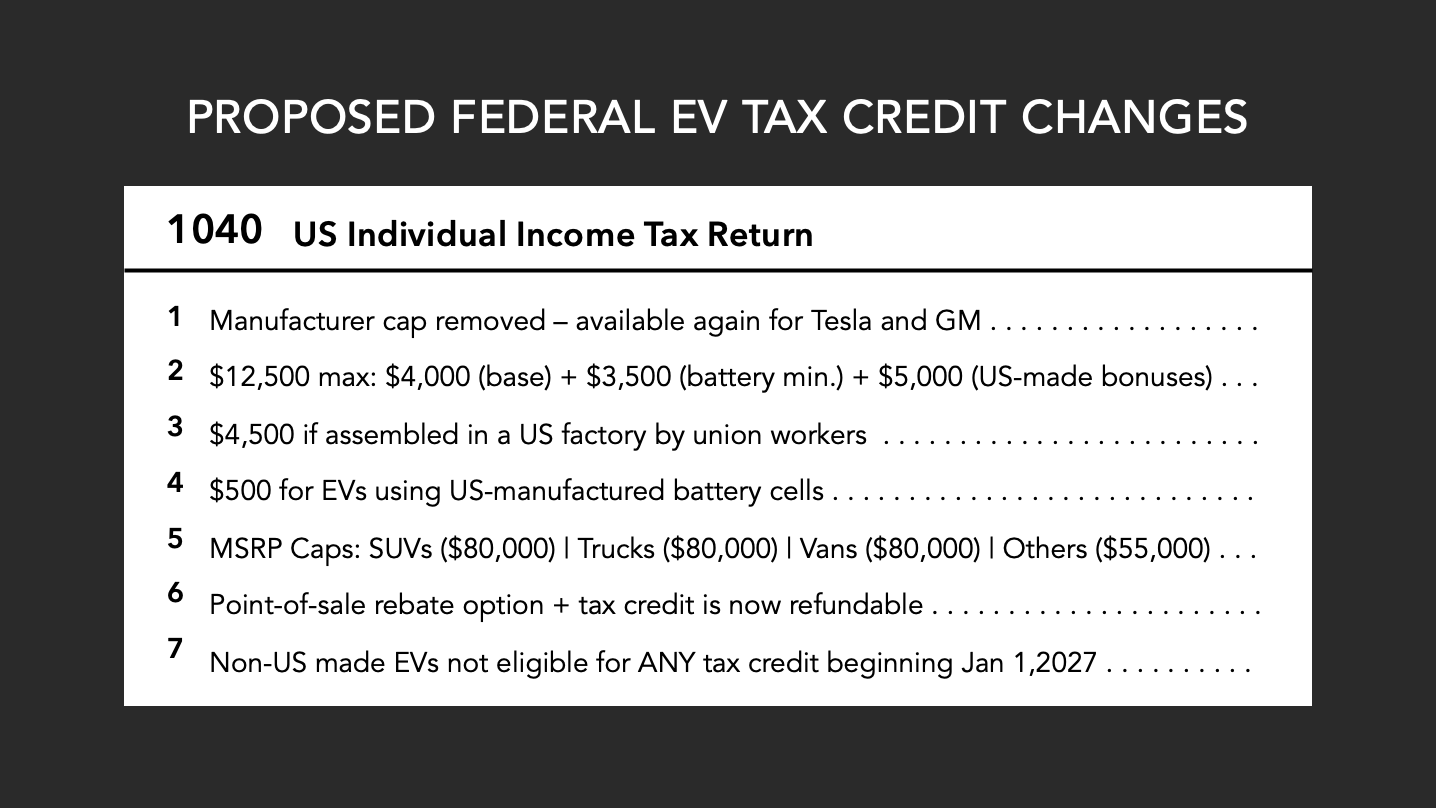

. The EV tax credit proposed by Biden and other Democrats would be an increase from the current 7500 credit to a maximum of 12500. However only specific types of electric vehicles. With the recent breaking news about EV tax credits included in the Inflation Reduction Act of 2022 there has been a lot of misinformation spreading on socia.

Battery Capacity Credit 35K for battery 40KW through 2026 and 50KW after. Right even the approach of American Jobs Plan Clean Cars for America requiring a. Domestic Assembly Credit 45K Domestic.

Ad Avalara solutions can help you determine energy and fuel excise tax with greater accuracy. The latest proposal involves up to a 12500 EV tax credit an increase from the current 7500 EV credit but with a number of potential changes. EV Tax Credit Expansion.

EVs without final assembly in US will not qualify for ANY tax credit effective January 1 2026. The new tax credits replace the old incentive system which only. The Electric CARS Act of 2021 has been introduced for the current Congress that would replace the 200k per-manufacturer cap with a 10-year end date so any EV acquired after December 31.

The bill would create a longer phase-in for the new EV tax credits North American final assembly requirement as well as its critical mineral and battery component provisions. A new bill introduced in the US Congress called the Affordable Electric Vehicles for America Act would allow essentially all EVs in the US to qualify for the 7500 tax credit if passed. Essentially the IRA killed some of the market this year so it could flourish in the futurewith the addition of a 4000 credit on used EVs costing up to 25000 a tax credit of up to.

Find a GM Electric Vehicle that Meets All Your Needs. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10. Tax Credit for new EVs is computed as follows.

Plus there is no guarantee that any such ceiling-raising wont come with an income limit or MSRP cap. Under the old system the EV tax credit of 7500 was applied to a narrower range of cars. The bill would allow car buyers to continue to claim the current 7500 federal tax credit for the purchase of clean vehicles the new preferred phrase describing plug-in hybrid battery.

Avalara can simplify fuel energy and motor tax rate calculation in multiple states. One of the most political and protectionist changes would eliminate any tax credit for EVs that. No the bill with the revised EV tax credit is not retroactive.

Cars assembled in North America can qualify for up to 7500 in federal EV tax credits 3750 if the battery components were built in North America and 3750 if critical minerals in. Those buying a pure EV stood to qualify in full from the credit whereas a purchaser of a plug-in hybrid. For example the possibility of Tesla and GM.

Ad Get You Where You Want to Go with GM EVs Powered By Ultium. First and foremost for EVs placed into service after December 31 2022 the Inflation Reduction Act extends the up to 7500 EV tax credit for 10 yearsuntil December. EV Tax Credit Expansion.

Ev Tax Credit Boost At Up To 12 500 Here S How The Two Versions Compare

Ev Tax Credit Expansion Deal Reached By Senate F 150 Lightning Forum For Owners News Discussions

The E Bike Act Tax Credit Should Be Retroactive I Bought Two Super73s In 2020 Jeez R Super73

Ev Tax Credit What It Means For Car Buyers And The U S Auto Industry

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

Zero Motorcycles And Other Electric Motorcycles Eligible For A Retroactive 10 Tax Credit Adventure Rider

Inflation Reduction Act Revives Hope For Biden S Climate Agenda

Ev Federal Tax Credit Electrek

Proposed Changes To The Federal Ev Tax Credit Passed By The House Of Representatives Evadoption

Are Ev Tax Credits Retroactive Carsdirect

Climate Bill Would Create Roadblock For Full Ev Tax Credit E E News

Ev Tax Credit Expansion Still On Hold Carsdirect

No The Bill With The Revised Ev Tax Credit Is Not Retroactive R Electricvehicles

Ev Tax Credit Deal Unintended Consequences Alarming Grid Situation Ford Earnings Call Youtube

Us Announces Retroactive Subsidy Extension Electrive Com

The New Ev Tax Credit In 2022 Everything You Need To Know Updated Yaa

No The Bill With The Revised Ev Tax Credit Is Not Retroactive R Electricvehicles

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet